Request a demo specialized to your need.

An evidence-first playbook for vendor invoice matching in trials.

Vendor invoices are one of the most persistent sources of financial friction in clinical trials. Sponsors and CROs depend on a complex ecosystem of CROs, central labs, imaging vendors, eCOA providers, logistics partners, and niche service suppliers—each operating on different billing models, timelines, and interpretations of scope. When invoices arrive, finance teams often discover misalignment with contracts, trial activity, and accruals that should have been resolved weeks earlier.

“Vendor invoice matching that works” is not about faster approvals alone. It is about designing a system where invoices reconcile naturally to trial reality—where amounts, timing, and scope are already understood before the invoice hits Accounts Payable. This requires rethinking invoice matching as a continuous, activity-driven control, not a month-end reconciliation task.

Why Invoice Matching Fails in Clinical Trials

Traditional invoice matching approaches were built for procurement scenarios with predictable purchase orders and static deliverables. Clinical trials operate very differently.

Trial costs are driven by events, not orders—patient enrollments, visits completed, samples processed, reports delivered, milestones achieved. When invoices are validated only against contract line items or high-level budgets, mismatches are inevitable. Finance teams are left to reconcile invoices manually, chasing operations and vendors for explanations.

Common failure modes include:

-

Invoices not aligned to actual trial activity

-

Milestone claims submitted prematurely or ambiguously

-

Pass-through costs bundled without transparency

-

Scope creep masked as “operational variance”

-

Late discovery of overbilling after payments are made

The result is delayed close cycles, strained vendor relationships, and weak audit defensibility.

Reframing Invoice Matching as a Trial-Aware Process

Effective invoice matching in trials starts with a mindset shift:

Invoices should be validated against what actually happened in the trial, not retrofitted to financial assumptions.

This reframing positions invoice matching as the last checkpoint in a chain of financial intelligence—not the first time discrepancies are noticed. When trial activity, contracts, accruals, and forecasts are already aligned, invoice matching becomes confirmation rather than investigation.

The Foundations of Invoice Matching That Actually Works

Contract-Driven Financial Logic

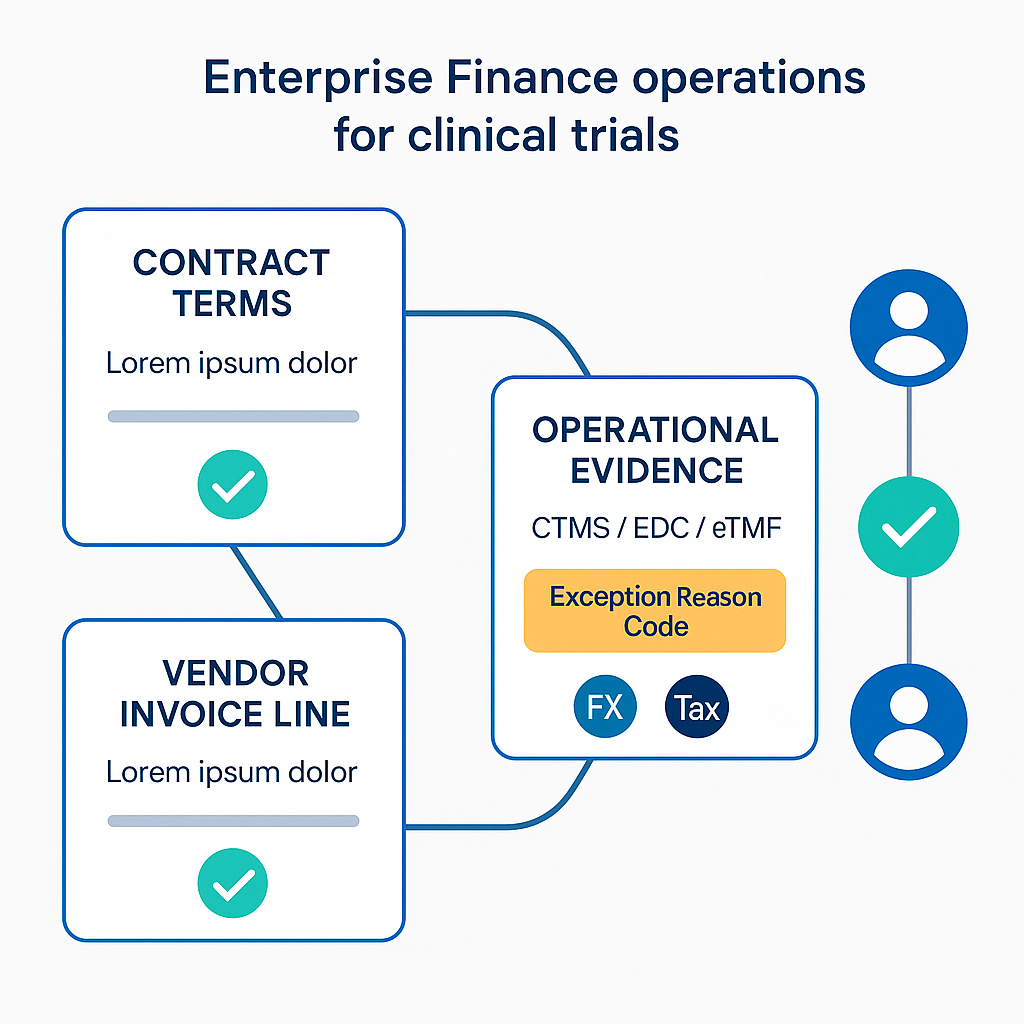

Every vendor contract defines what is payable and when. Effective systems translate that language into executable financial rules—per-patient fees, per-visit charges, milestone triggers, unit rates, caps, and exclusions.

When invoices arrive, they are automatically evaluated against contract logic. If a vendor bills for a milestone that has not been operationally achieved, the discrepancy is flagged immediately. This removes subjectivity and protects both parties with clear, defensible rules.

Activity-Based Validation

Invoices must reconcile to trial events, not just contract terms. For example:

-

Lab invoices match samples processed

-

CRO monitoring invoices match completed visits

-

Imaging invoices match scans performed

By tying invoices to CTMS, EDC, or vendor data feeds, organizations ensure that what is billed reflects what actually occurred. This eliminates the guesswork that plagues manual matching.

Accruals as the Bridge Between Operations and Invoices

One of the most overlooked aspects of invoice matching is the role of accruals. When accruals are calculated continuously—based on real trial activity—invoice matching becomes dramatically simpler.

Accruals establish an expected payable baseline. When an invoice arrives, finance teams are not asking, “Is this reasonable?” They are asking, “Does this align with what we already accrued?” Variances are surfaced early, categorized clearly, and resolved quickly.

This approach transforms invoice matching from a reactive process into a controlled financial handshake.

Handling Milestones, Pass-Throughs, and Complexity

Clinical trials introduce billing complexity that generic AP systems cannot handle well.

Milestones require clear operational proof—enrollment thresholds, database locks, report deliveries. Matching works only when milestone definitions are explicitly tied to trial systems and validated automatically.

Pass-through costs demand transparency. Effective matching breaks down pass-throughs by category and supporting documentation, preventing bundled charges from slipping through unchecked.

Multi-country trials add currency, tax, and regional scope nuances. Mature matching frameworks normalize invoices into a consistent financial view while preserving local detail for compliance and audit.

Exception Management Without Losing Control

Even the best systems will encounter exceptions. What differentiates high-performing organizations is how exceptions are handled.

Modern invoice matching frameworks:

-

Classify exceptions by root cause (scope, timing, rate, documentation)

-

Route them to the right owners—operations, procurement, or vendors

-

Enforce approval thresholds and documentation standards

-

Maintain a complete audit trail of resolution

This turns exceptions into managed events, not recurring chaos.

Auditability and Financial Defensibility

Auditors do not expect zero discrepancies. They expect control, consistency, and evidence.

Vendor invoice matching that works produces:

-

Clear linkage between invoices, contracts, and trial activity

-

Documented validation logic and approvals

-

Traceable resolution of discrepancies

-

Consistent treatment across vendors and studies

When auditors ask why an invoice was paid, the answer is no longer buried in email threads—it is visible, structured, and defensible.

Strategic Value Beyond AP Efficiency

While invoice matching improvements often start in finance, their impact is enterprise-wide.

For sponsors, strong matching improves cash predictability, reduces overpayment risk, and strengthens investor confidence. For CROs, it protects margins and builds trust with clients through transparent billing. For vendors, it reduces disputes and accelerates payment cycles.

Most importantly, it aligns clinical execution with financial reality—closing the loop between what the trial does and what the organization pays.

The Future: Intelligent, Predictive Invoice Matching

The next evolution goes beyond matching to prediction:

-

Identifying vendors likely to submit non-compliant invoices

-

Forecasting invoice timing based on trial signals

-

Recommending proactive corrections before invoices are issued

AI-assisted invoice intelligence shifts finance from validation to prevention—reducing friction before it occurs.

Conclusion: Make Invoice Matching Boring—and That’s the Goal

In clinical trials, invoice matching should not be a monthly crisis. When contracts are executable, activity is visible, accruals are current, and exceptions are governed, invoice matching becomes routine, fast, and trustworthy.

Vendor invoice matching that works is not about better policing. It is about better design—where financial truth flows naturally from trial execution. In an environment of rising costs and increasing scrutiny, that design is no longer optional. It is foundational to sustainable, scalable clinical development.

Subscribe to our Newsletter