Request a demo specialized to your need.

Implement three-way matching that speeds site payments and reduces disputes.

Three-Way Matching: Turning Site Payments from Negotiation into Governance

Clinical trial site payments are one of the last areas in clinical operations where scale, precision, and trust routinely break down. Despite advances in CTMS, EDC, and eTMF platforms, many sponsor–site payment reviews still devolve into manual reconciliation, email debates, and delayed disbursements. The root cause is not technology maturity—it is the absence of a clearly defined, shared matching model.

Three-way matching changes that equation. When designed correctly, it transforms site payments from subjective negotiation into a reproducible financial control that stands up to audit scrutiny while accelerating cash flow to sites.

Defining the Matching Model and Shared Data Foundation

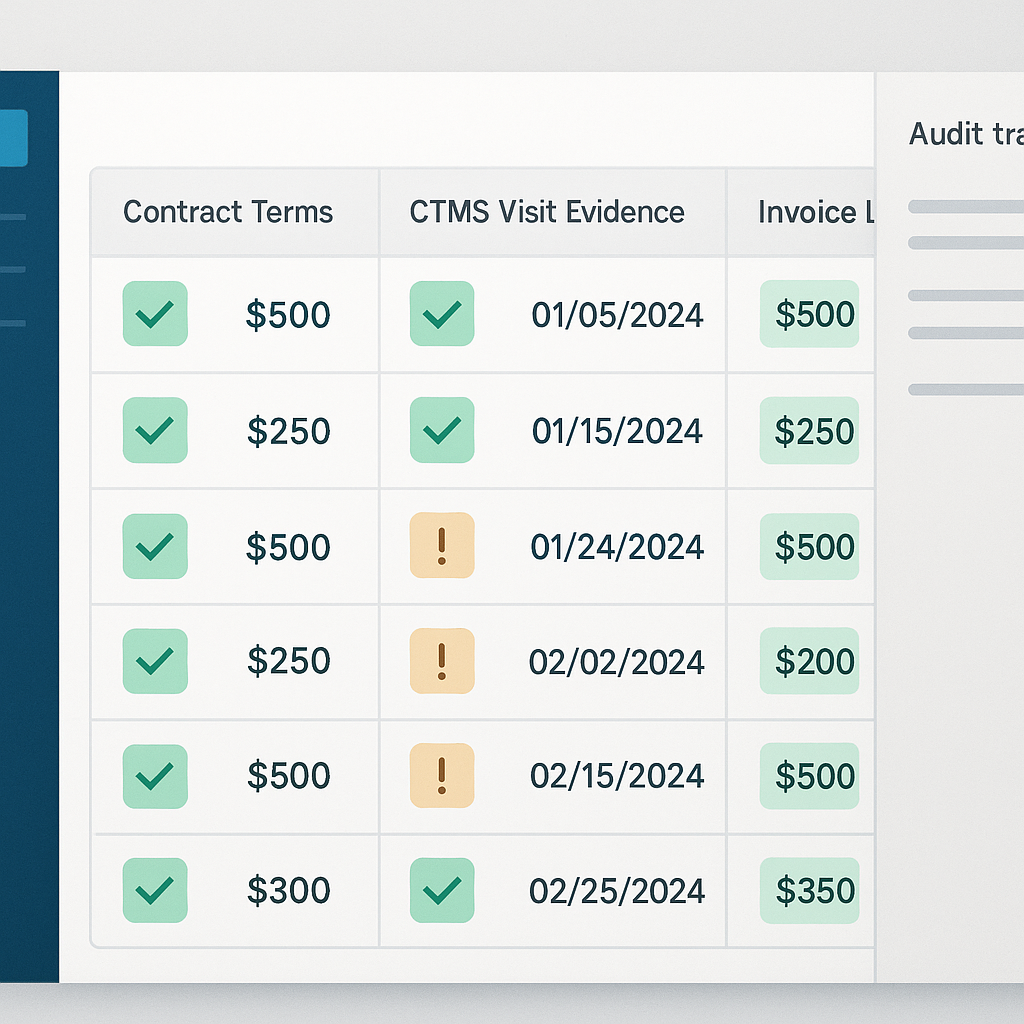

At its core, three-way matching enforces a simple principle: every payable must reconcile what was agreed, what occurred, and what was billed. These correspond to contract terms, operational evidence, and invoice lines. While the concept is straightforward, execution often fails because programs lack a shared, explainable data model.

The foundation is a one-to-one mapping between budget lines and operational triggers. Subject visits and procedures must align directly with CTMS and EDC records. Milestone-based payments must reference prerequisite events captured across CTMS workflows and essential documents finalized in eTMF. Pass-through costs should be cataloged upfront with explicit proof requirements, such as courier confirmations, imaging read acknowledgments, or translation receipts.

Consistency is critical. Stable identifiers—study, site, subject, visit, and milestone codes—must persist across systems so records align without fragile manual crosswalks. Just as important is defining evidence standards in advance: what constitutes acceptable proof, which date windows apply, what variances are tolerable, and who is authorized to approve exceptions. These definitions turn reconciliation into verification rather than interpretation.

Participant-facing payments require additional rigor. Programs must clearly distinguish between reimbursements—repayment of documented out-of-pocket expenses—and compensation or stipends for time and burden, which may carry tax implications depending on jurisdiction. Alignment between contracts, operational execution, and IRB/EC disclosures is essential. Authoritative guidance, such as participant payment perspectives from U.S. Food and Drug Administration, should anchor internal policy.

Cross-border trials introduce further complexity. Capturing and validating banking information such as IBAN and SWIFT/BIC upfront reduces downstream payment failures, an area where standards outlined by the European Payments Council provide clarity. Foreign exchange policy must also be deterministic. Declaring the rate source, booking window, and variance thresholds—and recording the rate source and timestamp on each transaction—eliminates ambiguity. When contracts, evidence, and policy are explicit, matching becomes a rapid confirmation step rather than a recurring debate.

Automating Matching, Holds, and Communication

Once the matching model is defined, automation is what allows it to scale across studies, regions, and thousands of transactions. Email-driven invoice reviews should give way to event-driven payables.

When a subject visit is completed and verified in CTMS or EDC, the system should automatically generate a payable candidate tied to the governing contract rate and linked evidence. When site activation milestones are met—regulatory approval, executed contracts, and required documents finalized in eTMF—the corresponding start-up fee candidate should be created with direct references to those artifacts.

Before any payable advances, automated pre-validation should occur. Syntactic checks confirm required fields and banking formats. Semantic checks ensure that a valid rate exists for the site and effective date. Conformance checks apply declared FX, withholding, and tax rules consistently. Routine items that fall within defined thresholds can be auto-approved, while exceptions are routed with standardized reason codes and resolution playbooks.

Transparency is as important as automation. Providing sites with real-time visibility into payment status—planned, generated, under review, approved, scheduled, and paid—dramatically reduces disputes. A modern site portal should surface governing contract references, linked evidence, FX and withholding details, and precise hold reasons with clear remediation steps. Industry bodies such as Association of Clinical Research Professionals and Society for Clinical Research Sites have long emphasized invoicing discipline; automation operationalizes those principles at scale.

Throughout this flow, segregation of duties and immutable audit trails are non-negotiable. Every match decision, approval, override, and payment must record who acted, when, why, and based on which evidence. This shifts effort away from detective reconciliation and toward controlled, reviewable execution—exactly what auditors expect.

Monitoring KPIs and Sustaining Audit Readiness

Even the best-designed matching engine requires ongoing oversight. Leading organizations measure performance across the full lifecycle: cycle time from operational event to disbursement, first-pass match rates, exception aging by root cause, and audit-trail completeness.

Breaking these metrics down by country, region, and site cohort quickly reveals systemic issues, such as recurring IBAN errors in specific geographies or persistent documentation gaps for certain budget line types. Maintaining a living evidence narrative is equally important. A review-ready binder—containing SOPs, validation summaries, configuration exports, and sample transaction trails—should allow an auditor to trace a payment from trigger to bank confirmation in minutes, not days.

Oversight should align with modern quality principles. Financial controls are not separate from trial integrity; they reinforce it. Shared terminology and proportional oversight concepts in International Council for Harmonisation guidance provide a common language for integrating payment governance into broader GCP quality systems.

Finally, high-performing programs close the loop through regular retrospectives. Planned versus actual payments are reconciled, exception root causes are analyzed, and insights are fed back into rate cards, playbooks, and site onboarding experiences. Over time, three-way matching fades into the background—not because it is absent, but because it works.

When matching is explicit, automated, and continuously monitored, site payments become predictable, auditable, and fast. The result is fewer disputes, stronger sponsor–site trust, and a financial control framework that scales with the complexity of modern global trials.

Subscribe to our Newsletter