Request a demo specialized to your need.

Introduction

Cell and gene therapy is an upcoming wave of therapeutic innovation in the healthcare and life sciences industry and is being pragmatically accepted worldwide. The gene therapy market reported its first market approvals back in 2017 and the evolution has been extensive ever since. The industry marked abundant gene-therapy-related activities, testing, and trials all well funded and financially supported by an influx of angel investors and venture capitalists.

Speaking of value growth, the global cell and gene therapy (CGT) market reached a value of nearly $4.39 billion in 2020 and is further expected to reach $34.31 billion in 2030 (Source: the business research company). Moreover, 12% of industrial clinical pipeline products and at least 16% of preclinical pipeline products consist of CGT.

The primary drivers for growth include increasing cancer and genetic cases and predicated applicability of CGT as a treatment. The industry is in its niche stage however has delivered some proven results which attracted increased research and investment from both public and private institutions.

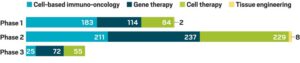

According to Frost & Sullivan reports, more than 400 cell and gene therapies were under trial in the preclinical and phase 3 in 2017-2018, which later witnessed a 27% Y.O.Y. increase in CGT clinical trials.

Segregation of cell and gene therapy conducted during 2020, based on clinical trial phases

(Source: Alliance for Regenerative Medicine)

(Source: Alliance for Regenerative Medicine)

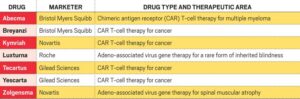

As of date, the FDA approved only 7 cell and gene therapy drugs, however, the product pipeline included ~1,200 experimental therapies. Predicting these data, the FDA estimates that by 2025, they would be approving ~10-20 CGT products annually.

The seven cell and gene therapies approved by the US Food and Drug Administration are:

(Source: FDA)

(Source: FDA)

North America Dominates the CGT Industry

Geographically, North America accounted for a share of over 60% of the global cell and gene therapy market in 2019 with over 530 regenerative medicine companies, including cell and gene therapy manufacturing developers.

The US and Canada are the major contributors to the cell and gene therapy market in North America. The major reasons are that the regulatory bodies are supporting several investigational products, fast track approvals, and regenerative medicine advanced therapy (RMAT) designation for the faster approval of the product into the market.

Market Landscape: Build, Buy, or Partner

The stakes in the CGT industry are relatively high for success and every bio-pharma company wants to be the pioneer with patents and ready-to-commercialized products (especially in the trending T-cell and viral vector domain).

However, the major challenge is the newness and uncharted territory of the CGT field for service companies. Complexities arise while trying to establish a standard, cost-efficient, and expert process for research and manufacturing. The constraints are multiplied with the absolute scarcity of subject matter experts and a fully trained workforce for an organic/in-house R&D.

Being a niche marketplace with extensive capital and expertise requirements, the major strategy playing around the CGT industry is leveraging highly on acquisitions and partnerships. This is also fairly driven by the high operational cost including logistics and manufacturing. After recognizing the potential of the CGT market, 16 out of the 20 largest biopharma companies by revenue, have recently included CGT products in their portfolio.

Some of the prominent CGT industry acquisitions and collaborations include:

- $875mn was paid by Charles River Laboratories to acquire Cognate BioServices in 2021, to expand its service portfolio in cell and gene therapy contract development and manufacturing

- $12bn acquisition amount was paid by ICON to acquire PRA Health Sciences to expand its market share in the clinical trial service industry.

- Catalent entered into collaboration with AavantiBio to enter the gene therapy manufacturing industry

- $315mn was paid by Catalent to acquire MaSTherCell in 2020 to gain accesses to large-scale manufacturing

- $109mn investment was made by Merck in April 2020 to gain organic expertise in viral vector and gene therapy manufacturing.

- 2 CAR-T cell therapies proposed by Bristol-Myers Squibb were approved by FDA in 2020. It is also all set to be launched.

- $4.3bn was paid by Roche to acquire Spark Therapeutics in December 2019, to introduce innovative and transformational CGT solutions into its portfolio.

- $1.7bn was paid by Thermo Fisher Scientific to acquire BrammerBio in 2019, to expand its cell and gene therapy CDMO business unit.

Another major business format emergence is Contract Development and Manufacturing Organization (CDMO). Experts believe that building internal CGT infrastructure is not only expensive but also technically complex and a CDMO business model can accelerate the process in a similar format as outsourcing.

With evolving requirements, the CDMO model also includes offering a well-equipped research place that could be rented out for trials and manufacturing with our own set of scientists.

Governmental Regulations and Support

The government support is phenomenal and is significantly helping in solidifying the industry’s sustainability. The regulatory framework governing the CGT industry is strict as well as collaborating concerning the fact that this industry deals with rare and orphan diseases. The FDA understands the criticality and therefore often designates these CGT products for priority review with an accelerated approval process.

Subscribe to our Newsletter