Request a demo specialized to your need.

Engineer DCT payments, FX, and controls for fast, compliant execution.

Designing Cost and Payment Models for Decentralized Clinical Trials

From Ad-Hoc Reimbursements to Event-Driven, Evidence-Based Finance

Decentralized clinical trials (DCTs) are not simply traditional trials with fewer site visits. They fundamentally reshape where work happens, how it is evidenced, and when it is paid. Activities shift from investigator sites to patients’ homes, digital platforms, logistics partners, and distributed clinical service providers. As a result, financial models that were designed around visit-based site invoices struggle to keep pace with the operational reality of DCTs.

Leading sponsors and CROs are recognizing that DCT success depends as much on financial architecture as on clinical design. Cost models, contracts, and payment workflows must be re-engineered to align with decentralized modalities—while preserving regulatory compliance, ethical safeguards, and audit readiness.

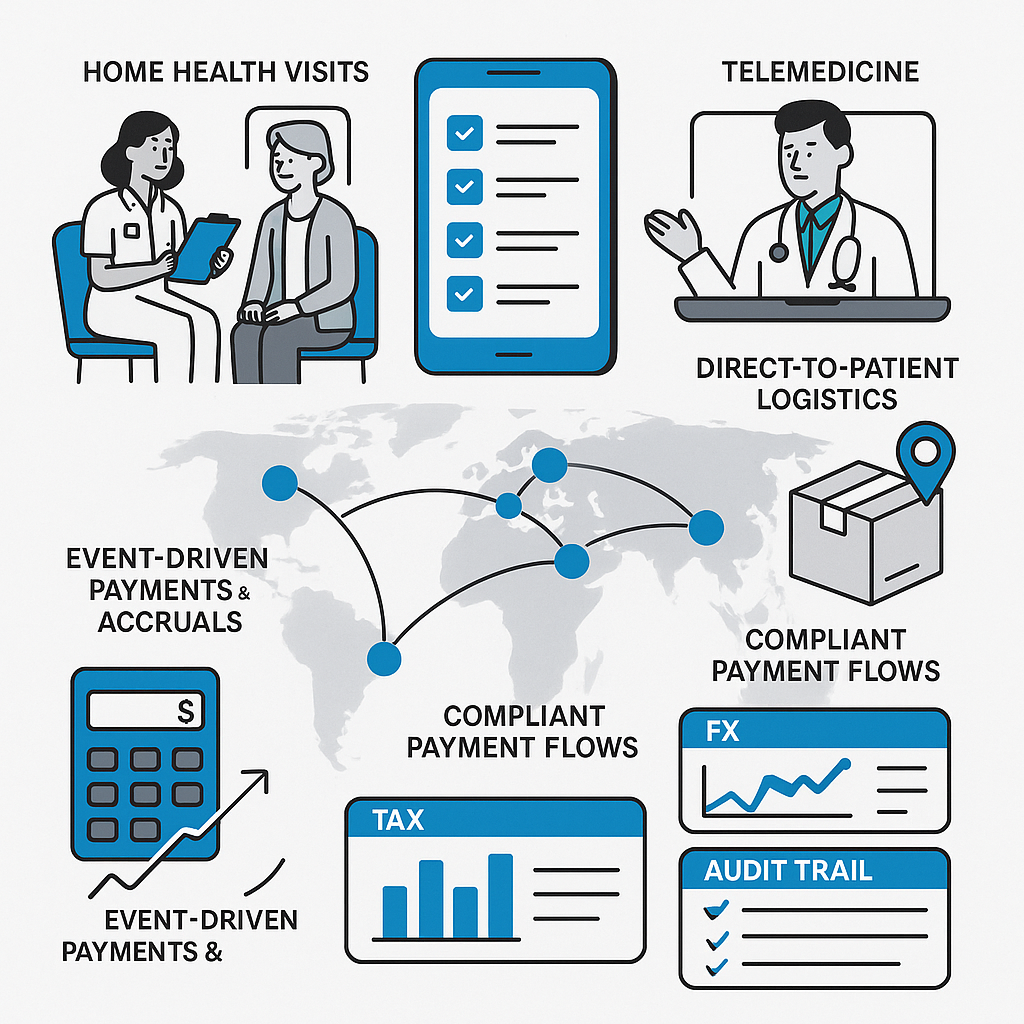

Mapping DCT Modalities to Cost and Evidence

The foundation of a scalable DCT financial model is clarity. Each decentralized modality must be explicitly mapped to its corresponding cost category, contractual term, and operational proof.

Typical DCT modalities include home health visits, telemedicine consults, eCOA and ePRO assessments, direct-to-patient (DTP) shipments, and continuous or episodic remote monitoring. For each modality, sponsors should define what constitutes verifiable evidence of work performed. A completed eCOA assessment may be evidenced by a timestamp, device ID, and system validation log. A home nursing visit may require eSource documentation, geolocation confirmation, and visit duration. A DTP shipment may require courier tracking, proof of delivery, and confirmation of kit integrity.

These evidence artifacts should not exist in isolation. They must be contractually aligned with budget line items and fair-market-value (FMV) assumptions so that invoiceability is unambiguous. When operational triggers, contractual language, and financial rules are harmonized, disputes decline and cycle times compress.

Rethinking Participant Payments in a Decentralized World

Participant-facing payments take on heightened importance in DCTs. While travel reimbursements may decrease, new costs emerge—connectivity, device usage, at-home services, and increased time spent interacting with digital tools. Financial models must clearly distinguish between reimbursements (documented out-of-pocket expenses) and compensation or stipends (time, inconvenience, and burden).

Ethical guidance is critical here. Regulators emphasize that participant payments must avoid undue influence while remaining fair and transparent. The perspective of FDA on subject payments reinforces the need for well-defined boundaries and documentation. These distinctions should be reflected not only in informed consent language, but also in payable-generation rules within financial systems.

Early master-data planning is essential. Sponsors must inventory supported payout methods by country, tax documentation requirements, banking formats, and consented identifiers needed to route payments securely. Foreign exchange (FX) assumptions—such as who bears conversion costs and which rates are applied—should be codified up front. Similarly, costs associated with device provisioning, connectivity support, and patient technical assistance must be explicitly budgeted so financial models reflect true operational effort.

All of this design should be grounded in modern quality principles, ensuring that financial controls scale with risk rather than administrative habit. The updated framework in ICH E6(R3) reinforces this risk-proportionate approach and provides a strong conceptual anchor for DCT financial governance.

Operationalizing Event-Driven, Cross-Border Payables

Once the model is defined, execution becomes the differentiator. High-performing DCT organizations operationalize finance through event-driven automation. In this paradigm, verified operational events automatically generate pre-validated payable candidates. A completed eCOA triggers a stipend, a verified telemedicine consult triggers a provider fee, a home visit triggers a visit-based payment, and a confirmed shipment triggers a logistics expense.

Three-way matching—between contract terms, operational evidence, and invoice lines—dramatically reduces approval friction and accelerates disbursement. At the same time, global trials demand country-aware controls. Banking validations such as IBAN and BIC/SWIFT checks reduce rejects in SEPA regions, while sanctions screening and segregation of duties protect against compliance risk.

FX discipline must be engineered into workflows rather than handled manually after the fact. Clear policies—spot versus average rates, booking windows, and variance thresholds—ensure that financial results are reproducible and defensible. Tax “country packs” should standardize withholding rules, local forms, and documentation by payee type. For participant reimbursements, IRB or EC materials must align with actual payment practices, and supporting documentation must be retained alongside financial records.

Regulators increasingly expect computerized systems supporting clinical trials to produce validated, secure, and traceable records. Each automated approval and payment should generate a time-stamped, user-attributed audit trail with linked evidence and reason codes, supporting inspection readiness without manual reconstruction.

Monitoring, Reconciling, and Demonstrating Value

In decentralized trials, financial performance is inseparable from operational visibility. Role-based dashboards should provide continuous insight into payment status, exception aging, FX variance, and audit-trail completeness across countries, vendors, and service providers. Cycle times—from event occurrence to payable generation to disbursement—should be measured explicitly, with service-level targets that enable rapid course correction.

Reconciliation must be systematic and modality-aware. eCOA and ePRO completion counts should reconcile directly to stipends paid. Home health visit logs should reconcile to visit-based payments. Courier records should tie cleanly to logistics expenses. Importantly, the reconciliation rules themselves should be documented so results are repeatable and explainable.

Because DCTs often generate high volumes of small, frequent transactions, scalability matters. Evidence packs that bundle micro-payments with their source proofs enable efficient review without sacrificing traceability. Inspection readiness is sustained through an end-to-end evidence narrative that links SOPs, system validation artifacts, configuration exports, and representative transaction trails.

Risk-based oversight remains essential. Financial controls tied to critical-to-quality factors highlighted in ICH E6(R3) should be reviewed on a fixed cadence. Where trials rely heavily on remote assessments, centralized monitoring concepts can surface early risk signals—such as sudden drops in completion rates that may affect both data quality and participant payments. Industry frameworks from TransCelerate BioPharma offer useful guidance in this area.

From Complexity to Confidence

When designed thoughtfully, DCT financial models do more than move money. They reinforce ethical conduct, accelerate study timelines, and enhance participant experience—all while standing up to regulatory scrutiny. By aligning decentralized modalities with evidence-based triggers, automating event-driven payables, and embedding risk-proportionate governance, sponsors can transform DCT finance from a source of friction into a strategic advantage.

In the decentralized era, predictable, equitable, and audit-ready financial operations are not optional. They are foundational to the future of clinical research.

Subscribe to our Newsletter