Request a demo specialized to your need.

Turn CTMS events into auditable journal entries with secure automation.

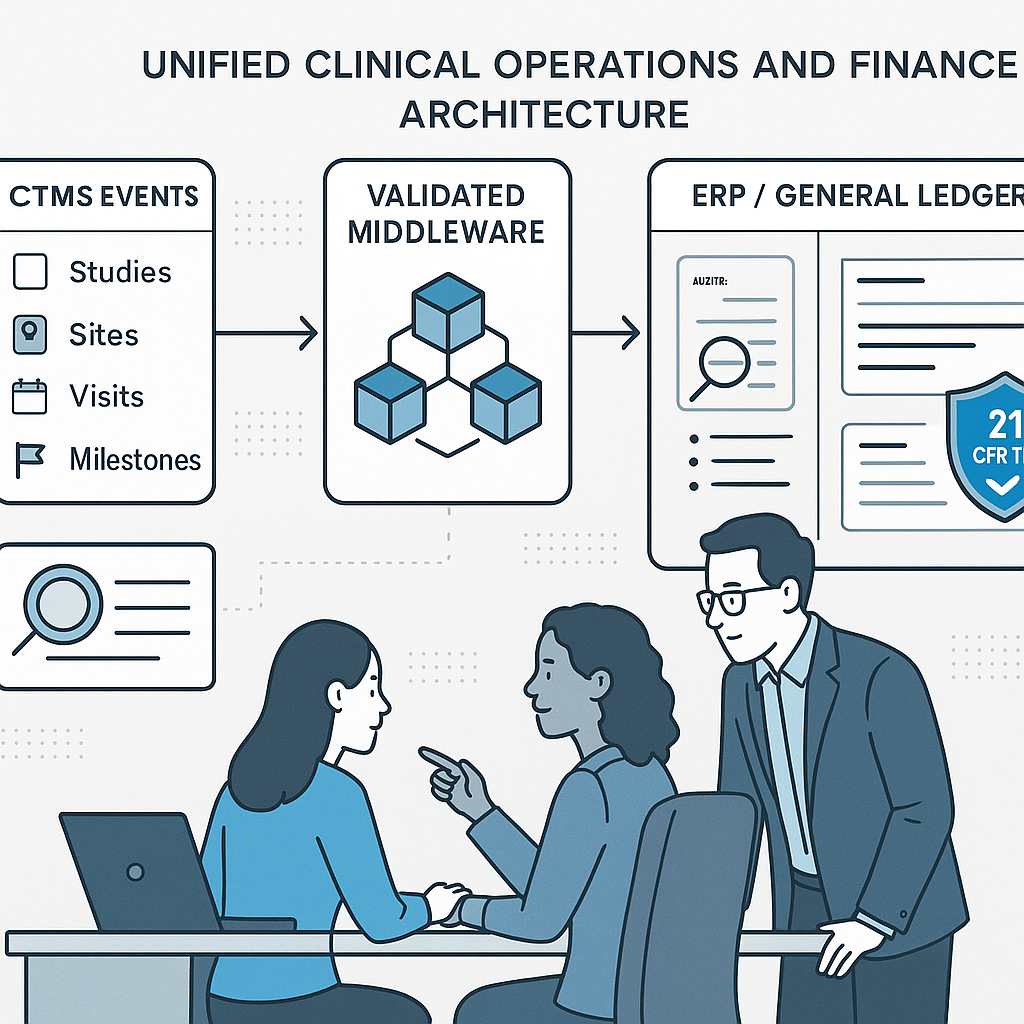

From Clinical Events to Journal Entries: Why a Shared Data Layer Is the Missing Link Between CTMS and ERP

Most CTMS–ERP integrations fail quietly. Data moves, interfaces run, and invoices post—but finance still reconciles by hand, sites question payments, and audits demand explanations that no system can easily provide. The problem is rarely tooling. It is the absence of a shared semantic layer that translates clinical reality into finance-ready truth.

A durable integration starts by agreeing on meaning before wiring messages.

Mapping Clinical Reality to Finance with a Shared Semantic Layer

The foundation is normalization. Core study building blocks—countries, sites, visits, procedures, milestones—must be uniquely identified, versioned, and explicitly linked to contract terms and cost categories. Each potential financial trigger should be defined once, with three elements: the operational evidence of record, the eligibility rule that determines when the trigger is finance-ready, and the financial outcome it produces.

For example, a per-visit payment may require a completed visit in EDC with no open critical queries for that visit. A start-up fee may require regulatory approval, executed contracts, and an essential-document pack finalized in eTMF. When these rules are explicit and shared, ambiguous invoices disappear—and trust with sites and vendors increases.

Master data that finance depends on but operations often overlook must be treated as first-class citizens: banking formats and tax pack status by country, rate cards and modifiers (screen failures, early terminations), currency preferences, and approval thresholds. These should be owned, versioned, and effective-dated so the integration never relies on tribal knowledge. Cost categories should be defined narrowly enough to map accurately to the general ledger, yet stable enough to survive protocol amendments.

A living data dictionary is the contract between teams. It explains how CTMS objects map to ERP structures—the chart of accounts, subledgers, and dimensions such as study, country, site, and vendor. Auditors will ask to see this contract, and regulators expect it to be supported by validated, secure, and traceable records, consistent with principles outlined by the U.S. Food and Drug Administration for computerized systems used in clinical trials.

Designing data lineage is equally critical. Organizations must document how operational evidence flows through transformations into journal entries, where calculations occur, how rounding and foreign exchange policies are applied, and which system is authoritative when discrepancies arise. Framing these decisions through a modern quality-by-design lens—reflected in guidance from the International Council for Harmonisation such as ICH E8(R1) and ICH E6(R3)—keeps focus on what is critical to quality rather than on exhaustive control for its own sake.

Automating Journal Entries with Validated, Auditable Flows

Once the shared data layer is defined, automation becomes both possible and safe. Each finance event should be treated as the output of a rules engine that evaluates eligibility, calculates amounts, and attaches evidence.

When a site activation milestone is satisfied, the system should automatically raise a payable candidate and generate the corresponding accrual or expense entry in the ERP subledger, with direct references to CTMS and eTMF evidence. When a visit is completed, event-driven logic should create a pre-validated payable linked to visit IDs, subject IDs, and contracted rates. Three-way matching—contract terms, operational evidence, and invoice lines—then becomes the default, allowing approvals to focus on true exceptions rather than routine transactions.

Layered validation is what makes automation defensible. Syntactic checks ensure required fields and formats are present. Semantic checks confirm business rules, such as whether a valid rate exists for the site and effective date. Conformance checks apply FX and tax policies based on country-specific logic.

FX policy must be explicit and encoded: whether spot or rolling average rates are used, the booking window, and who bears conversion costs. Banking requirements for cross-border payments—IBAN, SWIFT/BIC, CLABE—should be validated before disbursement, drawing on standards maintained by bodies such as the European Payments Council. For participant reimbursements that generate financial entries, alignment with ethics guidance—such as the FDA’s perspective on subject payments—helps avoid undue influence while maintaining compliance.

Architecturally, transport concerns should be separated from business logic. Queues provide resilience, idempotent processing supports retries and updates, and correlation IDs allow acknowledgments and errors to reconcile quickly. Every automated action should write an immutable audit record—who acted, what changed, when it happened, and why. Where controls and configurations are modeled as machine-readable artifacts, open standards like those illustrated by the National Institute of Standards and Technology OSCAL initiative offer principles for portable, testable control documentation.

Governing, Measuring, and Evolving Integration for Inspections

Sustaining integration quality is as much a governance challenge as a technical one. Leading organizations establish cross-functional change boards that own mapping tables, validation packs, and policy configurations for FX, tax, and evidence rules. Any change that affects financial outcomes requires an impact assessment, versioned change log, and rollback plan.

Operational dashboards provide early warning. Message throughput, exception aging, auto-match rates, on-time disbursement ratios, FX variance within tolerance, and audit-trail completeness should be visible end-to-end. Metric targets should align with critical-to-quality factors, reinforcing the proportional oversight principles emphasized in ICH E6(R3).

Inspection readiness depends on proving not just design, but operation over time. A living “plan-to-proof” package should link SOPs, validation summaries, configuration exports, mapping dictionaries, sample transaction trails, and training records. Periodic mock audits—tracing a transaction from clinical trigger through journal posting and payment—build confidence before regulators arrive. In contexts where U.S. tax or disclosure requirements intersect with financial records, awareness of FDA expectations around investigator financial disclosures ensures records reconcile cleanly when reviewed.

Finally, integration must learn. Reconciling estimates to actuals, analyzing variance by site and cost type, and feeding insights back into mapping and rules keeps the model current as studies evolve.

Integration as a Strategic Capability

When clinical events map cleanly to finance through a shared data layer, CTMS-to-ERP integration stops being a brittle interface and becomes a strategic capability. Finance gains real-time visibility, clinical teams see predictable payments, and compliance becomes a by-product of disciplined design rather than a scramble at audit time.

Done well, integration turns finance from a reactive clean-up function into a transparent, trusted partner to clinical operations—without sacrificing speed or compliance.

Subscribe to our Newsletter