Request a demo specialized to your need.

Use CTMS signals to forecast CTFM risk before close.

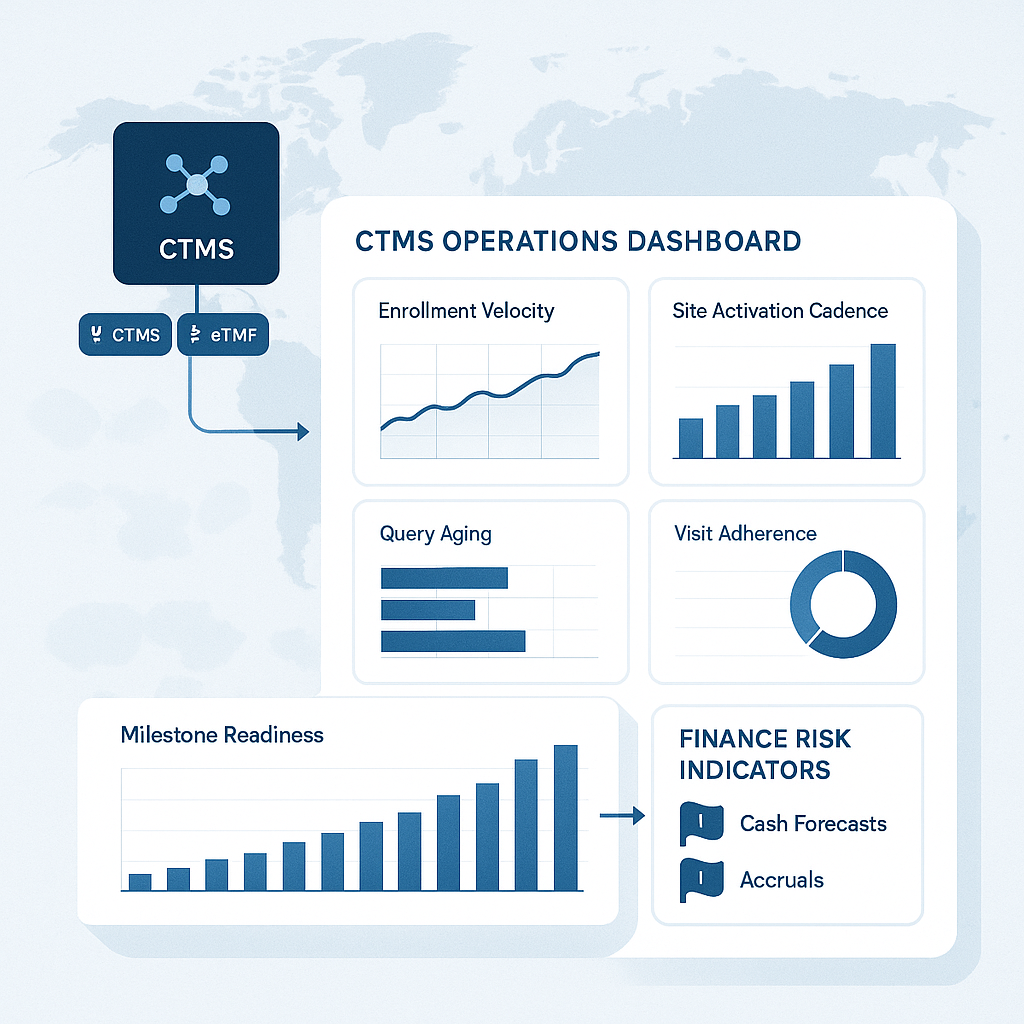

Turning Operational Telemetry into Financial Foresight

Executive Perspective: Why Finance Risk Starts in CTMS

Clinical trial finance risk rarely originates in accounting systems. It begins much earlier—inside day-to-day operational decisions captured in the Clinical Trial Management System (CTMS). Enrollment delays, site underperformance, protocol deviations, and monitoring backlogs are not just operational inconveniences; they are early warning signals of future financial exposure.

For sponsors and CROs, the challenge is not lack of data but lack of interpretation. CTMS platforms generate vast amounts of operational telemetry, yet finance teams often see the impact only weeks or months later—when accruals miss expectations, invoices spike, or forecasts collapse. The next evolution of clinical finance is about detecting finance risk upstream, directly from CTMS signals, before costs materialize.

Reframing CTMS as a Financial Risk Sensor

CTMS has traditionally been positioned as an execution and oversight tool for clinical operations. However, when viewed through a financial lens, CTMS becomes something more powerful: a real-time sensor network for cost, cash, and margin risk across the trial lifecycle.

Every operational signal—planned versus actual visits, site activation velocity, protocol compliance, monitoring cadence—has a direct financial consequence. Organizations that connect CTMS signals to financial models move from reactive cost management to predictive financial control, aligning operations, finance, and executive decision-making around a shared risk narrative.

Enrollment Velocity Signals

Enrollment velocity is one of the most powerful predictors of financial risk. Slower-than-planned enrollment extends study timelines, increases fixed costs, and delays milestone-based payments tied to trial progress. Conversely, faster-than-expected enrollment can create short-term cash pressure as site payments, pass-throughs, and CRO fees accelerate.

CTMS enrollment dashboards provide early insight into these dynamics. Deviations between planned and actual enrollment curves—especially when segmented by site or country—signal future forecast instability. When finance teams monitor enrollment velocity directly from CTMS, they can adjust accruals, cash forecasts, and funding strategies before financial variances become visible in the ledger.

Site Activation and Start-Up Delays

Site start-up timelines are often underestimated sources of financial risk. Delays in site activation push enrollment to the right, compress recruitment windows, and increase overhead costs without delivering corresponding trial progress. These delays also cascade into vendor inefficiencies and extended monitoring commitments.

CTMS data on IRB approvals, contract execution, and site readiness provides early indicators of start-up risk. When multiple sites or countries lag behind plan, finance exposure compounds. Proactive analysis of CTMS start-up signals enables earlier interventions—such as reallocating resources or adjusting vendor scope—reducing downstream budget overruns and cash burn surprises.

Monitoring and Visit Compliance Signals

Monitoring activity is a direct cost driver in clinical trials. Missed, delayed, or over-frequent monitoring visits affect CRO fees, travel expenses, and internal resource allocation. CTMS tracks planned versus actual monitoring visits, making it a rich source of financial risk indicators.

Patterns such as repeated visit delays or excessive unplanned visits often point to deeper issues—site quality challenges, protocol complexity, or staffing gaps. Left unchecked, these signals translate into change orders, higher CRO invoices, and increased rework costs. Finance teams that monitor CTMS compliance trends gain early visibility into creeping cost drivers that rarely appear as line items until it is too late.

Protocol Deviations and Amendments

Protocol deviations are not just quality concerns; they are financial risk multipliers. High deviation rates often lead to protocol amendments, additional monitoring, retraining, and extended timelines—all of which increase trial cost and complexity.

CTMS captures deviation frequency, severity, and root causes across sites and regions. When these signals trend upward, they foreshadow future financial exposure well before budgets are revised. Integrating deviation analytics into finance forecasting allows organizations to anticipate amendment costs, re-baseline budgets earlier, and avoid last-minute funding surprises.

Site Performance Variability

Not all sites contribute equally to trial progress—or financial efficiency. CTMS performance metrics such as enrollment contribution, data quality, query resolution time, and visit adherence reveal which sites deliver value and which generate disproportionate cost.

Persistent underperformance is a strong predictor of financial leakage. These sites consume monitoring resources, extend timelines, and increase remediation costs without proportional enrollment return. Identifying these patterns early through CTMS enables finance-informed decisions—such as site replacement or enrollment caps—that protect both trial timelines and financial outcomes.

Vendor and CRO Execution Signals

CROs and vendors execute a significant portion of trial activity, and CTMS often serves as the system of record for their performance. Missed milestones, delayed deliverables, and inconsistent reporting are not just operational issues; they are leading indicators of invoice disputes and budget overruns.

By correlating CTMS execution data with contractual obligations, organizations can identify variance risk before invoices arrive. This enables proactive governance conversations, data-driven change control, and stronger financial defensibility—reducing the cycle of post-hoc reconciliation that plagues many trial finance teams.

Financial Forecasting Through CTMS-Driven Intelligence

When CTMS signals are systematically mapped to financial drivers, forecasting becomes both faster and more reliable. Instead of relying on static assumptions, forecasts evolve dynamically as operational reality changes—reflecting enrollment shifts, site performance trends, and execution risk in near real time.

This integration transforms forecasting from a finance-only exercise into a cross-functional intelligence capability. Finance leaders gain explainable forecasts grounded in trial execution, while clinical leaders understand the financial consequences of operational decisions as they happen.

Strategic Value for Sponsors and CROs

For sponsors, CTMS-driven finance risk detection improves capital efficiency, funding predictability, and investor confidence. Early visibility into cost drivers allows better portfolio prioritization and more disciplined decision-making across studies.

For CROs, these signals support margin protection and proactive client communication. Identifying risk early enables scope discussions based on evidence, not hindsight—strengthening partnerships and reducing end-of-study financial conflict.

Conclusion: From Operational Data to Financial Advantage

CTMS signals are no longer just tools for operational oversight; they are leading indicators of financial health. Organizations that learn to interpret these signals gain a decisive advantage—anticipating finance risk before it materializes, aligning teams around shared insight, and transforming uncertainty into control.

In an environment of rising trial complexity and tighter financial scrutiny, the ability to predict finance risk from CTMS data is not a technical enhancement. It is a strategic capability—one that separates reactive trial management from financially intelligent clinical execution.

Subscribe to our Newsletter