Request a demo specialized to your need.

Build always-on control health for faster, audit-ready CTFM.

Clinical Trial Financial Management (CTFM) sits at the intersection of science, operations, and finance. It governs how budgets are planned, contracts are executed, sites and vendors are paid, accruals are recognized, and financial risk is controlled across the lifecycle of a study. Yet in most organizations, financial controls around trials are still episodic, manual, and retrospective—applied during quarterly closes, audits, or inspection preparation.

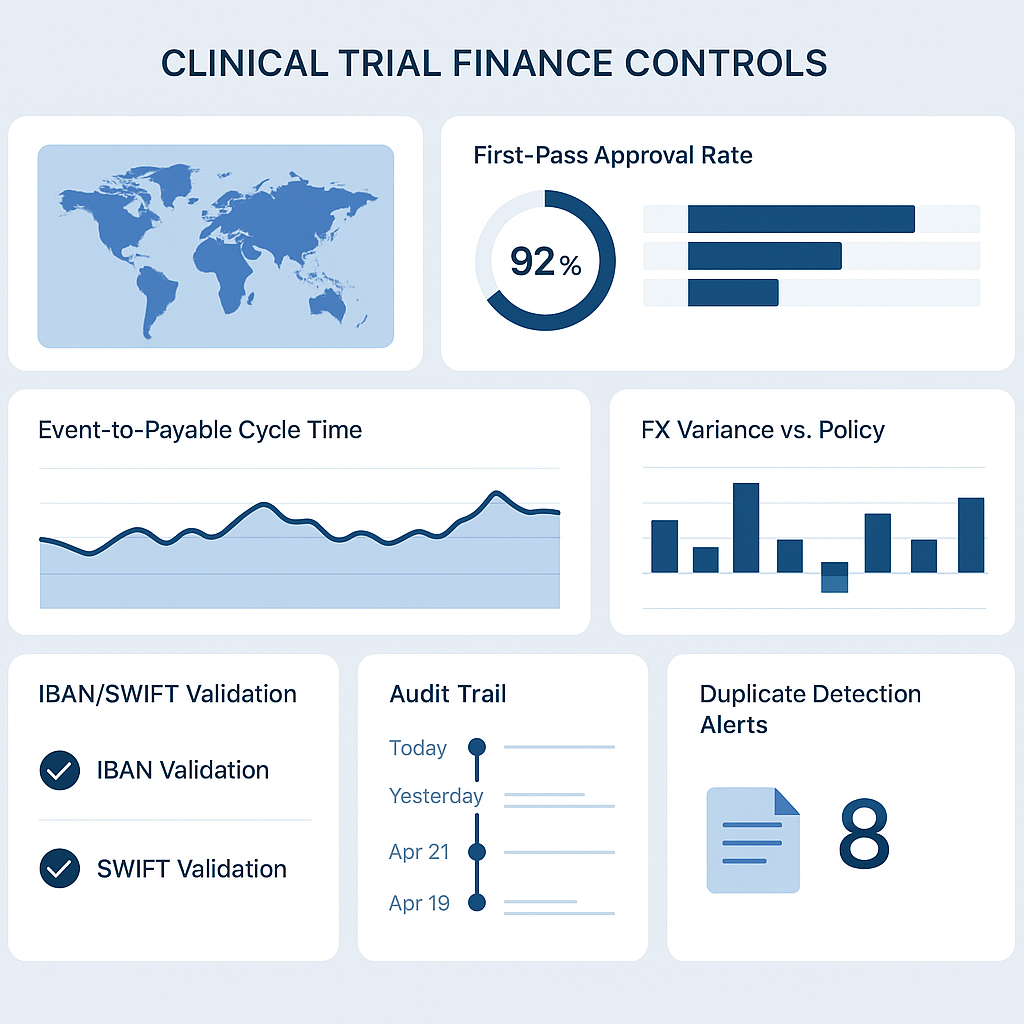

Continuous Controls Monitoring (CCM) represents a fundamental shift in how sponsors, CROs, and finance leaders manage trial financial risk. Instead of discovering issues months later, CCM embeds always-on, automated controls directly into CTFM processes—detecting deviations in real time, enforcing policy at the point of execution, and creating a living audit trail aligned with regulatory and financial compliance expectations.

This article explores what Continuous Controls Monitoring means in the context of CTFM, why it is becoming mission-critical, and how modern platforms and AI can operationalize it at enterprise scale.

Why Traditional Financial Controls Fail in Clinical Trials

Clinical trials are uniquely complex financial environments:

-

Thousands of site-level transactions tied to subject visits and milestones

-

Multiple contract types (per-patient, per-visit, pass-through, holdbacks)

-

Cross-functional dependencies between CTMS, EDC, eTMF, and ERP systems

-

Global regulatory and accounting requirements (SOX, ASC 606, IFRS, Part 11)

Most organizations still rely on periodic reconciliations and manual review to validate:

-

Whether payments align with executed contracts

-

Whether accruals match actual subject activity

-

Whether budget amendments are approved and traceable

-

Whether invoice payments violate caps, thresholds, or timelines

By the time discrepancies are found, money has already moved, corrections are costly, and audit narratives are reactive. In an era of increasing trial complexity and cost pressure, this model simply does not scale.

What Is Continuous Controls Monitoring for CTFM?

Continuous Controls Monitoring for CTFM is the practice of embedding automated, policy-driven financial controls into clinical trial financial workflows—operating continuously rather than periodically.

At its core, CCM answers three questions in real time:

-

Is this transaction allowed?

-

Is it consistent with contract, budget, and protocol rules?

-

Is it properly authorized, traceable, and auditable?

Unlike static checklists or post-hoc audits, CCM operates in-flow—monitoring budgets, payments, accruals, and amendments as they occur.

Core Control Domains in CTFM Continuous Monitoring

1. Budget Integrity Controls

Continuous monitoring ensures that:

-

Site and vendor payments never exceed approved budget line items

-

Budget amendments are versioned, approved, and effective-dated

-

Forecasts dynamically reflect real enrollment and visit completion

This eliminates silent budget creep and provides finance leaders with real-time burn visibility.

2. Contract Compliance Controls

Automated controls validate that:

-

Payment calculations align with executed contract terms

-

Milestone triggers match protocol-defined events

-

Holdbacks, caps, and pass-through rules are enforced

Any deviation is flagged before payment execution—not after reconciliation.

3. Accrual Accuracy Controls

Instead of manual accrual spreadsheets, CCM enables:

-

Real-time accruals driven by actual subject activity from CTMS/EDC

-

Automatic reversal or adjustment when data changes

-

Transparent linkage between operational events and financial recognition

This dramatically improves close accuracy and reduces finance-operations friction.

4. Invoice & Payment Controls

Continuous controls monitor:

-

Duplicate invoices or payments

-

Invoices submitted outside allowable timelines

-

Payments lacking required approvals or documentation

Violations are blocked or routed for exception handling with full audit traceability.

5. Segregation of Duties (SoD) Controls

CCM enforces role-based separation between:

-

Budget creation vs. approval

-

Contract execution vs. payment authorization

-

Accrual calculation vs. financial posting

This is essential for SOX compliance and inspection readiness.

The Role of Automation and AI in CCM

Manual rules alone are insufficient for modern trials. Advanced CCM leverages automation and AI in three critical ways:

-

Rule Engines: Encode financial policies as executable rules (thresholds, caps, timelines, approval paths).

-

AI-Driven Anomaly Detection: Identify outliers such as unusually high site payments, inconsistent visit costs, or abnormal accrual patterns.

-

Predictive Controls: Anticipate future budget overruns or cash-flow risks based on enrollment and historical trends.

Over time, these systems evolve from reactive monitoring to preventive and predictive financial governance.

CCM as a Strategic Enabler, Not Just a Compliance Tool

While compliance is a key driver, the strategic value of CCM for CTFM is broader:

-

Finance leaders gain confidence in accruals, forecasts, and cash management

-

Clinical operations gain speed by reducing manual reviews and rework

-

Executives gain visibility into trial financial health across portfolios

-

Audit readiness becomes continuous, not a fire drill

In effect, CCM transforms CTFM from a back-office function into a real-time decision support capability.

Platform Implications: Why Architecture Matters

Continuous Controls Monitoring cannot be bolted on. It requires a platform that is:

-

Unified: Budgets, contracts, milestones, payments, and accruals in one data model

-

Workflow-native: Controls executed as part of approval and execution flows

-

Audit-ready: Immutable logs, electronic signatures, and traceability

-

Configurable: Controls adaptable to different study types, geographies, and accounting policies

This is why next-generation, platform-based CTFM solutions—such as those delivered by Cloudbyz—are increasingly embedding CCM as a foundational capability rather than an afterthought.

The Future: From Continuous Monitoring to Autonomous Controls

The next evolution of CCM in CTFM will include:

-

Self-healing controls that automatically correct minor discrepancies

-

AI copilots that explain financial variances in plain language

-

Cross-domain controls linking safety events, protocol deviations, and financial impact

-

Outcome-based governance, where controls adapt based on risk profiles

As clinical trials become more decentralized, global, and data-intensive, continuous controls will be the only viable way to maintain financial integrity at scale.

Closing Thought

Continuous Controls Monitoring for CTFM is not just about preventing errors—it is about building trust. Trust in numbers, trust in processes, and trust that financial decisions are grounded in real-time truth rather than delayed reconciliation.

For organizations serious about operational excellence, compliance, and financial stewardship in clinical research, CCM is no longer optional. It is the new standard.

Subscribe to our Newsletter