Request a demo specialized to your need.

A clear, fast method to reforecast and control budgets after change.

From Reactive Amendments to Proactive Financial Governance

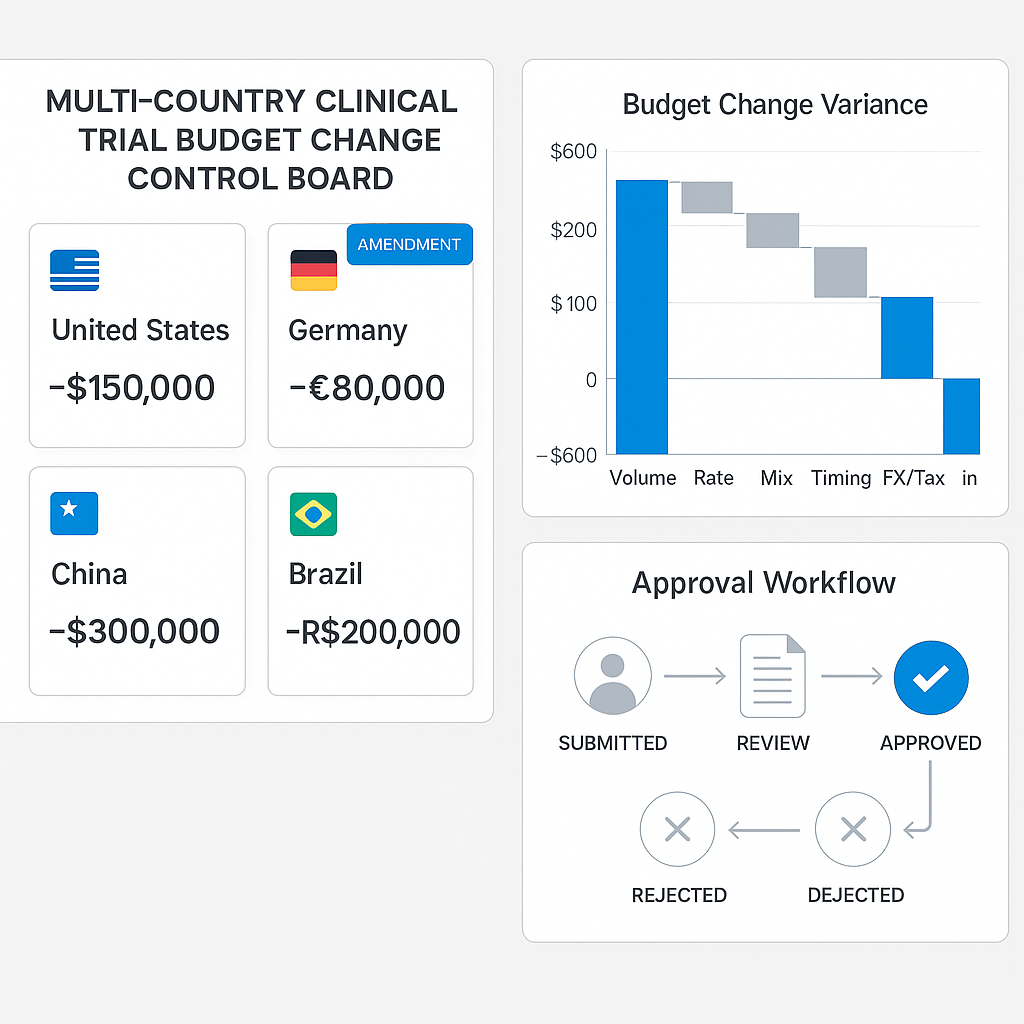

Multi-country clinical trials are inherently complex. Each geography introduces its own regulatory timelines, site economics, currency exposure, tax structures, and operational realities. While protocols may be global, budgets are never truly uniform. Yet many organizations continue to manage budget changes using fragmented spreadsheets, email-based approvals, and retrospective reconciliations.

Budget change control is no longer an administrative necessity—it is a strategic governance capability. In an era of accelerated study timelines, decentralized trials, and heightened financial scrutiny, sponsors and CROs must move beyond reactive budget adjustments toward controlled, auditable, and predictive financial change management.

Why Budget Change Control Breaks Down in Global Trials

Budget volatility is not an exception in multi-country trials—it is the norm. Changes arise continuously from both operational and external factors:

-

Staggered country start-ups and delayed site activations

-

Protocol amendments affecting visit schedules or procedures

-

Inflationary pressures and currency fluctuations

-

Local regulatory requirements driving additional activities

-

Vendor scope expansion and pass-through cost adjustments

Traditional budget processes treat these changes as isolated events. Each amendment is handled independently, often without understanding its cumulative impact across countries, vendors, and timelines. The result is budget creep, forecasting inaccuracy, and growing mistrust between clinical, finance, and procurement teams.

Reframing Budget Change Control as a Governance Framework

Effective budget change control in multi-country trials requires a shift in mindset. Instead of asking, “How do we approve this change?”, organizations must ask:

“How do we manage financial change as a controlled, traceable, and decision-driven process across the lifecycle of the trial?”

This reframing elevates budget change control from a transactional workflow to a cross-functional governance framework that balances flexibility with financial discipline.

Core Dimensions of Budget Change Control

Country-Specific Budget Baselines

Each country operates under distinct cost structures—site fees, patient reimbursement norms, monitoring intensity, and regulatory overheads. Mature organizations establish country-level baseline budgets that reflect local realities while still rolling up into a global trial view. This ensures changes are evaluated in the context of local impact and global consequence.

Structured Change Triggers

Not all budget changes are equal. Effective frameworks distinguish between:

-

Operational-driven changes (e.g., enrollment delays, site additions)

-

Protocol-driven changes (e.g., added visits or assessments)

-

External changes (e.g., FX rates, tax or regulatory shifts)

Classifying change triggers provides clarity on urgency, approval paths, and downstream impact.

Versioned Budget Lineage

Budget change control requires full traceability. Every approved change must create a new budget version, preserving the original baseline while clearly documenting what changed, why it changed, and who approved it. This lineage is essential for audit readiness, stakeholder confidence, and accurate accrual forecasting.

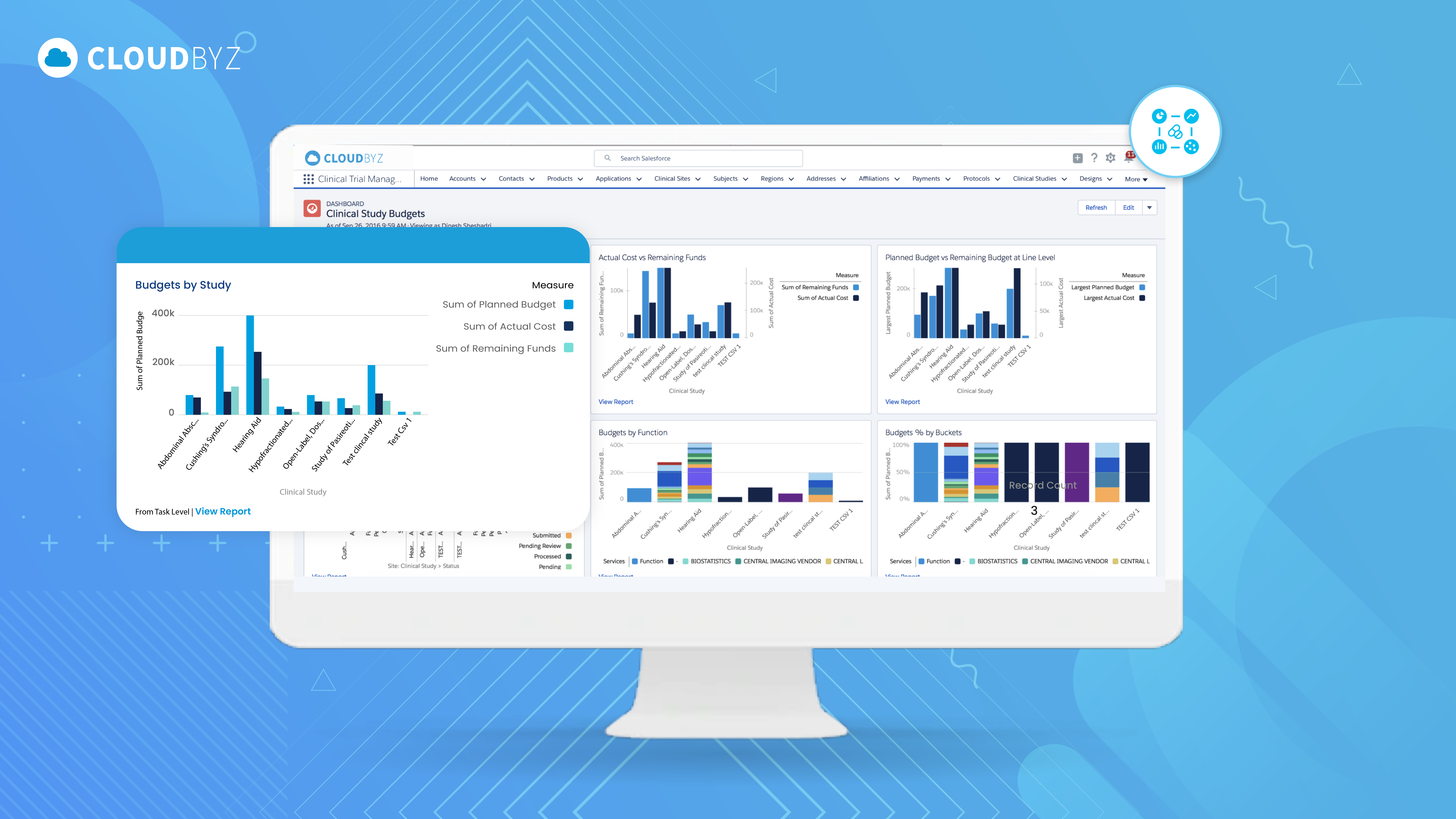

Operationalizing Budget Change Control at Scale

In modern Clinical Trial Financial Management (CTFM) environments, budget change control is embedded directly into operational workflows. When a country proposes a change—such as increased per-patient costs or additional monitoring visits—the system automatically assesses financial impact across:

-

Country-level budgets

-

Site contracts and payment schedules

-

Vendor agreements

-

Accruals and cash forecasts

This allows stakeholders to evaluate changes before approval, not after financial impact has already occurred.

Aligning Stakeholders Through Controlled Transparency

One of the most underestimated benefits of structured budget change control is organizational alignment.

-

Clinical Operations gain clarity on the financial implications of operational decisions.

-

Finance Teams gain predictability and audit-ready documentation.

-

Procurement and Legal maintain contract consistency and scope control.

-

Executive Leadership gains confidence that budget growth is intentional, justified, and governed.

When changes are visible, traceable, and contextualized, discussions shift from blame to decision-making.

Managing Currency and Regional Volatility

Multi-country trials are uniquely exposed to foreign exchange risk. Budget change control frameworks must incorporate:

-

FX-adjusted budget versions

-

Defined revaluation thresholds

-

Clear policies for absorbing versus escalating currency-driven changes

Without this discipline, currency fluctuations quietly erode budgets, often surfacing only during late-stage financial reconciliation.

The Role of Predictive Analytics and AI

Advanced CTFM platforms increasingly augment budget change control with predictive intelligence:

-

Early detection of countries trending toward budget overruns

-

Impact simulations of protocol amendments before approval

-

Pattern recognition across past trials to anticipate high-risk regions

This transforms budget change control from reactive cost containment into forward-looking financial risk management.

Strategic Value in an Era of Capital Discipline

As funding environments tighten and trial costs rise, the ability to govern budget change effectively becomes a competitive differentiator. Organizations with mature change control:

-

Protect trial margins without sacrificing operational agility

-

Shorten approval cycles while improving compliance

-

Build trust with investors, boards, and partners

-

Enable faster, data-driven decisions at the country level

Those without it continue to firefight—approving changes in isolation and reconciling financial reality long after decisions are made.

Conclusion: From Budget Adjustments to Financial Stewardship

Budget change control in multi-country trials is no longer about managing exceptions. It is about stewarding financial integrity across complexity. By establishing structured baselines, traceable change workflows, and predictive insight, sponsors and CROs can navigate global variability with confidence.

In a world where trials span continents and costs evolve continuously, disciplined budget change control is not bureaucracy—it is the foundation of sustainable, scalable, and trustworthy clinical development.

Subscribe to our Newsletter