Request a demo specialized to your need.

How agentic AI speeds payables, accruals, and compliance in trials.

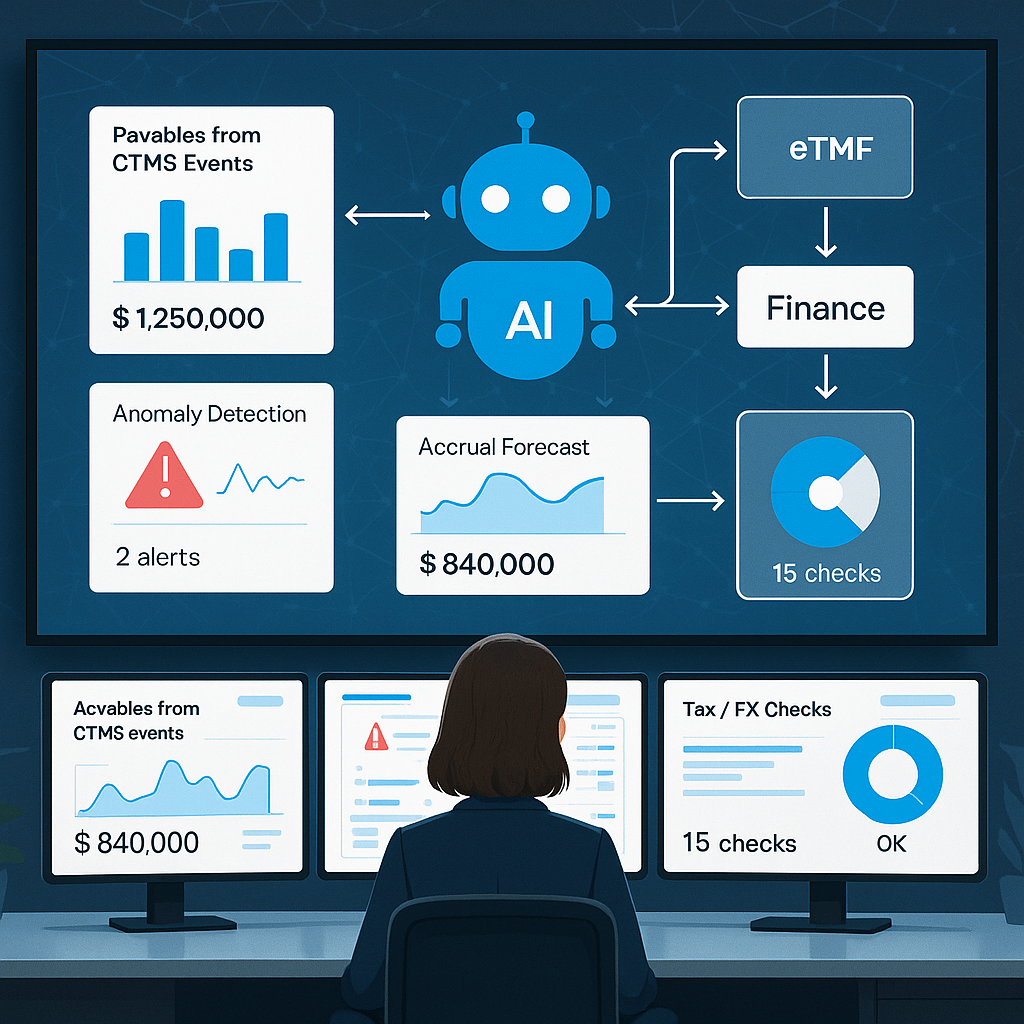

Orchestrating Payables and Accruals from CTMS Events

How Agentic AI Turns Operational Truth into Financial Confidence

In modern clinical trials, speed and trust are no longer opposing forces. Sponsors are under pressure to pay sites and vendors faster, forecast more accurately, and withstand deeper regulatory scrutiny—all while trial designs grow more complex and decentralized. Traditional finance workflows, built on manual handoffs and spreadsheet reconciliations, simply cannot keep pace.

This is where agentic AI changes the equation. Its real value is not automation for automation’s sake, but the ability to convert trusted operational signals into defensible financial outcomes—without human bottlenecks. In clinical research, that means orchestrating site and vendor payables, as well as monthly accruals, directly from CTMS, EDC, and eTMF events, with evidence inherently attached.

Declaring Finance-Eligible Events at the Source

Predictable finance begins with precision in the data model. Leading organizations explicitly declare which operational events are finance-eligible and under what conditions. Site activation, for example, is not a single checkbox—it requires regulatory approval, an executed contract, and a complete essential-document package in the eTMF. Per-visit grants are not payable simply because a visit occurred; they require a completed EDC record, CTMS verification, and confirmation that no critical queries remain open. Closeout fees similarly depend on documented completion of all closeout activities.

By encoding these requirements as deterministic rules, AI agents can evaluate eligibility consistently and generate pre-validated payable candidates that link directly to the governing contract terms. The result is a shift from subjective review to objective orchestration.

Accruals benefit from the same rigor. Instead of one-size-fits-all estimates, methods are aligned to cost behavior: unit-of-service for visit-driven activities, percent-complete for long-running services, and straight-line recognition for fixed phase fees. Agents refresh underlying drivers on defined cadences—weekly for enrollment and visits, monthly for deliverables—publish assumptions transparently, and calculate confidence bands based on recent variance. When journals are tied to a shared semantic layer, accruals become explainable, repeatable, and defensible.

Speed comes from automation. Trust comes from evidence.

Evidence-First Automation, Not a Black Box

In an audit-ready finance model, every AI action must be provable. Each payable candidate carries its source proofs: CTMS and eTMF readiness artifacts for start-up fees, EDC visit identifiers and timestamps for per-visit payments, courier confirmations or imaging receipts for pass-through costs. Rather than burying reviewers in transactions, outputs surface in role-based worklists that highlight only exceptions.

This design reframes AI from an opaque decision-maker into a transparent execution engine. Finance teams are no longer validating every line—they are validating the rules and intervening only where risk truly exists.

Detecting Anomalies and Policy Drift with Explainable AI

Even the best-designed rules degrade over time if they are not continuously tested against reality. Protocol amendments, country expansions, and rate-card updates introduce subtle shifts that manual reviews often miss. Explainable AI enables continuous detection of anomalies and policy drift—and, critically, explains why something looks wrong.

High-impact control libraries typically include three-way matching success rates, FX variance against policy bands, withholding accuracy by country, duplicate detection across payees, and latency from event to disbursement. AI models can flag outliers such as payments outside fair-market-value bands for a site cohort, sudden drops in auto-match rates after an amendment, implausible visit volumes relative to activation curves, or repeated banking rejects in a specific region.

Explainability is non-negotiable. Each alert should surface the features that triggered it—rate-card deviations, invalid visit windows, missing FX timestamps—and propose next best actions, whether that is requesting additional evidence, correcting a rate mapping, or re-running FX using the declared window. Where financial risks intersect with operational quality, aligning detection logic with risk-based monitoring principles ensures that finance and clinical oversight reinforce each other. Guidance from TransCelerate BioPharma offers a useful benchmark for this integrated approach.

Governing Agents for Validation and Inspection Readiness

Automation without governance creates speed at the expense of credibility. To be trusted, agents must operate within a validated, well-controlled framework aligned with regulatory expectations for electronic systems. Principles outlined by the FDA for computerized systems—validation, security, attribution, and auditability—apply directly to finance automations supporting clinical trials.

Effective designs separate business logic from transport layers so retries are idempotent and correlation IDs allow reviewers to trace a payment from trigger to bank confirmation in minutes. Segregation of duties is embedded by design: low-risk items may auto-approve within defined thresholds when all evidence is present, while high-value or exception cases require dual approval. Every action is written to an immutable audit trail capturing who approved what, when, why, and based on which evidence.

Validation follows a risk-based mindset. Intended use is documented, rules and data sources are tested, and changes are governed through controlled release cycles. Industry best practices, such as those described in ISPE GAMP 5, reinforce the importance of focusing validation effort where it matters most.

Closing the Loop with Measurable Outcomes

The final step is institutional learning. High-performing organizations publish clear metrics: cycle time from event to payable to disbursement, first-pass auto-approval rates, exception aging by reason, FX variance versus policy, and audit-trail completeness. Monthly retrospectives use these insights to refine rules, retrain models where justified, and update country packs and rate cards proactively.

When explainable AI operates inside a governed operating model, the benefits compound. Sponsors pay faster, disputes decline, forecasts stabilize, and audits become confirmations rather than investigations. Finance evolves from a reactive back office into a strategic, confidence-building function—powered by operational truth and designed for the realities of modern clinical trials.

Subscribe to our Newsletter